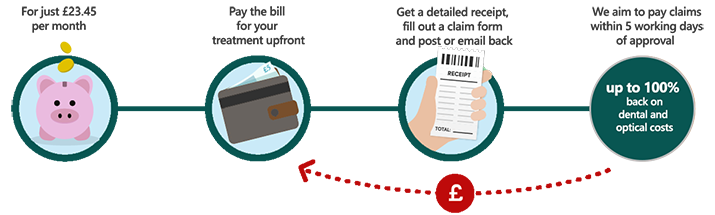

Put simply, the Health Cash Plan is an easy, low-cost way to look after your essential medical requirements, including 100% of your money back on dental and optical cover (up to a maximum of £130 benefit each per year). The plan also covers therapy treatments and you'll also get money back towards specialist diagnostic consultation fees.

With cover at £23.45 per month, a few treatments a year is often all it takes to see the plan pay its way.

Plus:

• There are no medical questions

• Cover for accidents is instant.

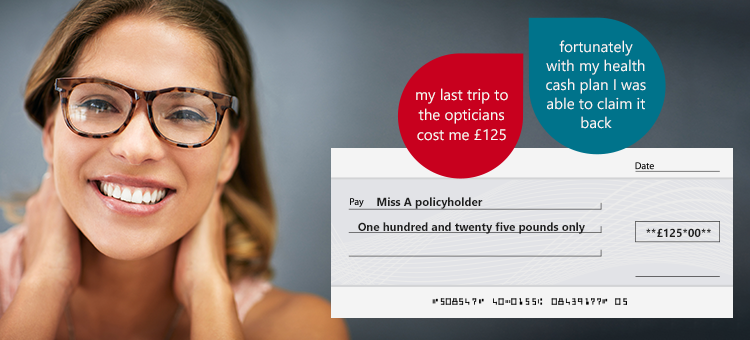

It isn't private medical insurance, but what it will do, is give you cash to cover more routine services, such as a visit to the optician, a dental filling or physio for a sore shoulder. It even pays out £200 for a new baby (a 300-day qualifying period applies). Terms and conditions apply, see policy wording for full exclusions and limitations.

Rather than relying on savings or a credit card, the health cash plan enables you to claim back some or all the expense.... because those expenses do add up!

Here's how it works:

This policy is underwritten by Stonebridge International Insurance Ltd, authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, register number 203188. Union Income Benefit Holdings Ltd and Stonebridge International Insurance Ltd are both members of the same group of Companies and are ultimately owned and controlled by the Parent Company Embignell Ltd, registered in England no 05871053.