Samantha, 48, from Merseyside, who claimed on the insurance:

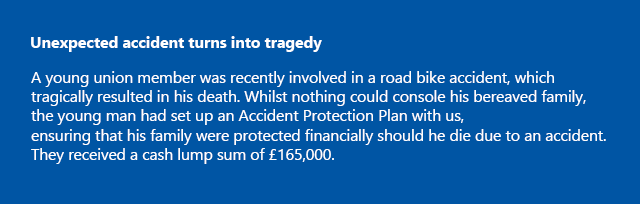

Samantha found herself in a car accident last year for which she was hospitalised for five days. Under this Accident Protection Plan, they would be paid £1,500.

Samantha was in a stationary car that was hit from behind. This aggravated a pre-existing back condition, which led to her being hospitalised, requiring MRIs and specialist treatment.

"...it kept my head above water…stopped me from drowning whilst I was in hospital, it made up for it because I was able to borrow the money knowing that I was getting money back.”

The money went towards petrol to and from hospital, gas and electricity bills and grocery shopping. Samantha is now also considering taking out Life Cover. "...my biggest fear in life is leaving first and not leaving my children with anything, I’ve been disabled all my life and it’s took me a lot to raise them on my own this is my way of saving up for them.”

When asked how she would rate her experience out of 5: “5, I was really made up, pleased with you. I’m trying to get my son with you he’s just started a job to be in a union.”

Charlene, 30, from Hampshire, who claimed on the insurance:

Charlene suffered a severe ankle fracture, the bones breaking in four places after falling off a ladder at work. She was hospitalised for five days, under this Accident Protection Plan, they would be paid £1,500.

Charlene liked that she could contact the claims team via email...“it was really fast, I did the whole thing online.”

She’s seven weeks into the recuperation process and with another six to go, it is a lengthy recovery. Receiving the payment meant peace of mind, knowing some of her bills can be paid.

When asked how she would rate her experience out of 5: “5+ has been brilliant, can’t improve on anything…wow, I’m gobsmacked with how fast the process was”