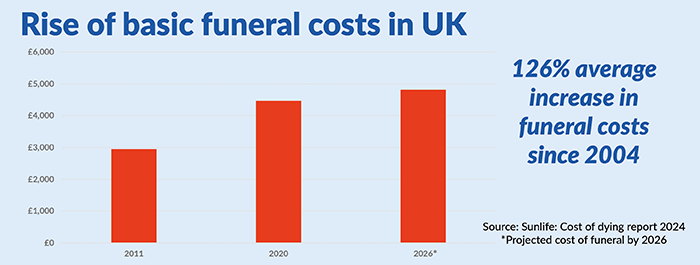

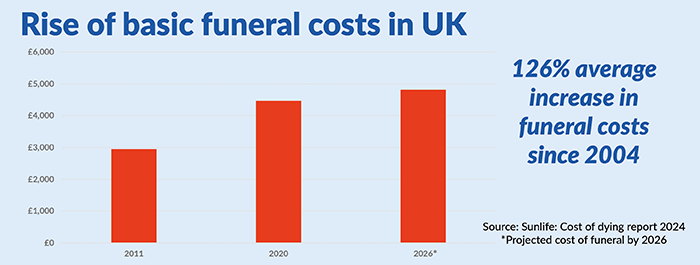

These days it’s easy to get caught up in the cost of living but fewer people are talking about the cost of dying. The average price of a basic funeral has risen substantially over the years and, according to the 2024 Cost of Dying report, now stands at £4,141. If you consider all the other associated expenses (professional fees, send-off costs, catering etc), the actual figure may be considerably higher: £9,658.

What relevance does this have to over 50s life insurance? Quite a lot, actually. Having a policy could help prevent your family being burdened with these funeral costs when you die, or help with any other outstanding debts, if you don’t have an existing savings pot to dip into. Plus, with Over 50s Life Insurance, a full payout of the benefit amount is guaranteed, if death occurs after the first 24 months and you continue to pay the monthly premiums when due. Cover for accidental death is immediate and after a 24-month waiting period, you’re completely covered for death by any cause.

Funeral plans are also an option, however, it’s also worth knowing that some funeral plans don’t guarantee to cover all the costs associated with a funeral.

What makes over 50s life insurance different is there’s huge flexibility to use the payout in other ways too. It can help provide financial support for loved ones, and be spent however they choose. It can help loved ones maintain their existing lifestyle or build a nest egg for the grandchildren. You could even donate it charity.

Another reason you might need an over 50s plan is if health problems have stopped you getting other forms of life insurance in the past. No matter how many times you’ve been declined for those, an over 50s policy is open to those aged over 50, regardless of medical history. This makes it particularly attractive if you have underlying medical condition or life limiting illness. Your loved ones will receive the full benefit on your passing, provided the 24-month qualifying period has been met. This can provide immense peace of mind and leave you to concentrate fully on staying well rather than worrying about family finances when you’re gone.

Finally, accidents happen. As with all unforeseen events, there’s nothing anyone can do to prevent that, but this policy does at least provide for your loved ones in the event of accidental death. Unlike the 24-month caveat mentioned above, in this instance payouts can be claimed from the moment the policy starts.

If you’re still not sure whether you need over 50s life insurance, take a look at the MoneyHelper website, a free service provided by the Money and Pensions Service. You’ll find the pros and cons of this insurance explained clearly, as well as alternatives to over 50s plans if you decide this cover isn’t for you.