“The only way you will permanently take control of your financial life is to dig deep and fix the root problem” –

Suze Orman

A report published by the TUC in January 2019 found that Britain’s household debt had reached a new peak, with UK homes owing an average of £15,385 to credit card firms, banks and other lenders. Working families are, on average, worse off today than before the financial crisis.

According to the general secretary Frances O’Grady, “Household debt is at crisis level. Years of austerity and wage stagnation has pushed millions of families deep into the red”1 . A report by Finder found that 280 people are declared insolvent or bankrupt in the UK every day. That’s one person every 5 minutes.2

According to The Joseph Rowntree Foundation, “1 in 6 people in the poorest fifth of the population report that they are in problem debt, most commonly falling behind with Council Tax payments, rent or utility bills”.3

Almost a third of British people believe they won’t clear their debts within their lifetime, with more than one in 10 people worried that they won’t even be able to reduce their debt levels.4

In the past, the main causes for debt included borrowing on credit cards, overdrafts, car loans and other forms of unsecured consumer credit.⁵ However, recent research shows that most people visiting Citizen's Advice are in debt to the public sector - tax credit overpayments, benefit overpayments and council tax arrears, as well as utility providers.

Research by the Trussell Trust showed that "half of food bank users" struggled to afford food and clothes because they were repaying universal credit debts.5

The consequences of debt have also impacted funerals. The average debt taken on by people who struggled to pay for a funeral in 2020 was £1,751, which – though reduced from the all-time high of £1,990 in 2019, still reflects the difficulty people face in covering the cost of burying a loved one. This issue is not simply a reflection of the economic stress caused by the pandemic. Figures show that between 2015 and 2018, the number of people requesting public health funerals (often referred to as “pauper’s funerals”) increased by 70%.6

In summary, the consequences of this financial stress are:

• Growing numbers of people using food banks

• Low levels of savings which means working families do not have a back-up plan

• We are feeling more stressed and anxious which means our relationships are suffering

• Growing pressure causing relationship breakdowns

• Increasing levels of child poverty

• We are getting further into debt

• Many people unable to afford a decent burial

We don’t want any of this to happen to you. By following our 6 steps, you can dramatically reduce the likelihood of your family ending up with these problems.

Step 3: Review any debt you have

“If you think nobody cares if you’re alive, try missing a couple of car payments” – Earl Wilson

Is all debt bad? It’s very difficult to live without any kind of debt, e.g., a mortgage, but certainly some debt is a lot worse than others. You don’t need to be a whiz with math's to understand that the higher the APR, the worse the debt. Payday loans, credit cards and overdrafts are some of the worse kind of debts. Often, we have debts of different types. Here’s what to do to help reduce your debt:

1. Take stock

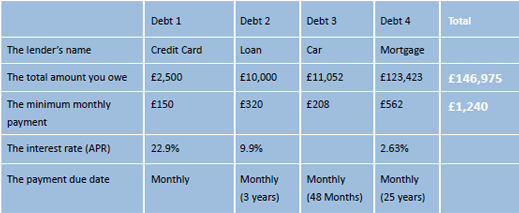

It’s important to understand how much you owe, so make a list of all the money you owe and include all relevant information about the debt – Please see the following example:

2. Work out how much you can pay

Where possible, it's best to pay more than the minimum repayment, so add up all of your monthly expenses, such as rent/mortgage, bills, food, utilities, insurances; the monthly payments on your debts and any additional regular payments such as entertainment – you may also want to consider starting to put money aside for savings. Then subtract that figure from your monthly after-tax income i.e., take-home pay and the remaining is what you could put towards your debt repayment each month.

3. Get on the phone

Start calling the lenders and see if they can improve the terms of the debt – can they lower the interest rate or waive late fees? If you have a good credit rating, you may even be able to transfer your balance to a low or 0% deal. Your target is to reduce your APR, so consider consolidating your debt in one loan at an APR lower than any of the current APR rates.

4. Contact your Union

In first instance contact your union to establish if they have a Credit Union. If they do this is likely to be the cheapest loan facility you will find. Contact the Credit Union and ask them if they will lend you an amount equal to the total debt you owe, ask them what the cost of this loan will be and how they can help you consolidate your existing debt.

5. Research potential lenders

If your union does not have a credit union or they cannot lend you the amount you need, start approaching high street lenders. Again, ask them if they will lend you an amount equal to the total debt you owe, ask them what the cost of this loan will be and how they can help you consolidate your existing debt.

6. Pay off your high interest debt

Once your loan is approved, contact your existing lenders and ask them how to pay off the balance that you owe. Then once you receive your loan, immediately pay the lenders.

7. Pay less each month

As your debt is no longer split over a series of different high interest lending options, your new loan will cost you less each month than what you were paying before.

8. Break the cycle

As you start paying off your debt, it can be tempting to treat yourself by splashing out on non-essential items, but just a few purchases and all your hard work could be undone. Maybe consider getting rid of the credit cards and only buying with cash or your debit card.

9. Access free support for help with debt

It’s comforting to know that there are several organisations and charities who are on hand to provide expert free advice and practical solutions handling bills and debt. No matter how big or small your money problem is, no one will judge your situation. They might suggest ways of paying your debt/bills in ways you may have not considered.

Here are some organisations who are always on hand to help if you struggle with debt and have problems with paying bills:

• StepChange: www.stepchange.org

• Debt Advice Foundation: www.debtadvicefoundation.org

• Citizens Advice Bureau: www.citizensadvice.org.uk

• National Debt Helpline: www.nationaldebtline.org

The key is to find non-profit debt counselling help. This means a one-to-one session with someone paid to help you, rather than make money out of you. It's important not to confuse this with 'free help' as many commercial companies say they're free as you're not charged directly, but you still end up paying somehow.

If you’re working on a low income, you might be entitled to some benefits or tax credits which we’ll cover later. You can find out which benefits you can take by visiting your local Citizen’s Advice Bureau. Simply go to www.citizensadvice.org.uk to find your nearest branch.

You can even use the Turn2Us website (https://benefits-calculator.turn2us.org.uk/) to help you calculate your benefits entitlement – make sure that you have information about your savings, income, pension, childcare payments and any existing benefits (for you and your partner) to hand.

Coming up in Step 4…

The importance of saving

Sources:

1 TUC: Unsecured debt hits new peak of £15,400 per household, 7th January 2019

2Finder: Debt statistics UK 2020, 2nd December 2020

3Joseph Rowntree Foundation UK Poverty 2018 Report

4The Independent: Third of Britons believe they will never clear their debts, 28th September 2018

5Guardian Newspaper; Covid has exacerbated soaring problem debt levels in the UK, 2nd December 2020

6Fair Funerals: What is funeral poverty?