“Money worries are the biggest strain on our relationships…”

- Dr Marjoribanks from Relate

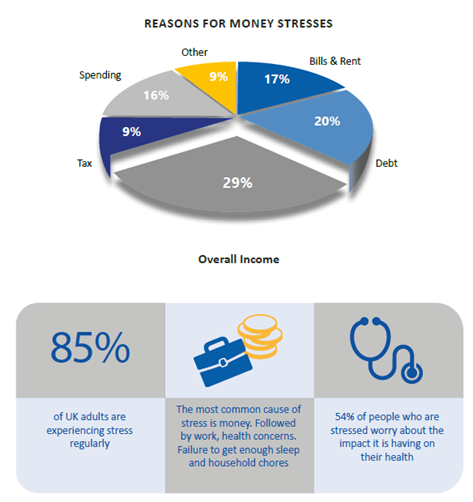

We are a society struggling with stress. According to the Trade Union Congress, 15.4 million working days were lost between 2017- 2018 due to stress-related health issues2. Shockingly, 77% of us are stressed about money according to a 2018 survey carried out by Metro’s Mentally Yours and Toluna3. It’s no wonder that the theme of Mental Health Awareness Week that year was stress. A 2020 survey1 by the Office for National Statistics shows the pandemic has fuelled anxiety further, with many concerned about loss of income and finances.

Many things can lead to stress. Sometimes it’s triggered by a major life-event such as divorce or losing a job. A survey in January 2018 by a UK company, Forth, supports this view that we are a society battling stress on a daily basis. Findings show the most common cause of stress is money, followed by work and health worries.4

Step 2: You could save £4,395 a year!

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” - Martin Luther king, Jr.

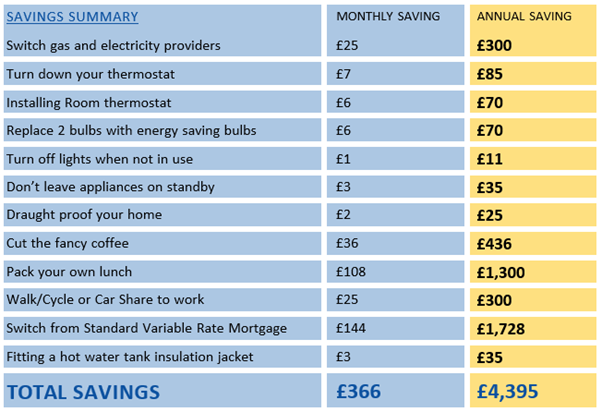

Below are some basic quantifiable money saving tips with a proven track record:

1. Switch energy providers

The average household could save up to £300 per year by switching gas and electricity supplier according to Ofgem. Setting up and paying by direct debit attracts further savings with most providers.5

2. Turn down your Thermostat

Turning it down by just 1 degree could cut your heating bills by up to 10%, and save you around £80 a year, according to Energy Saving Trust. If you don’t already have a room thermostat, installing one could save up to £70 a year.6

3. Choose your lighting carefully

Replacing just one old light bulb with an energy saving one or LED lighting can cut lighting costs by up to £35 a year. Turning off your lights when they are not in use can save more; up to £13 a year on your energy bills. 6

4. Don’t leave appliances on standby

Households spend an average of £30 leaving appliances on standby, so make sure to switch off at the plug.6

5. Draught proof your home

According to the Energy Saving Trust, draught proofing windows and doors in your home could save you around £25 per year.7

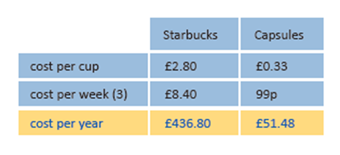

6. Cut out fancy coffee

According to British Coffee Association, 80% of people who visit coffee shops do so at least once a week, whilst 16% of us visit on a daily basis. Assume you just avoid 3 high street coffees per week at an average spend of £2.80 each. Total saving is £8.40 per week and a staggering £436.80 per year.8

7. Take your own lunch to work

Research shows that 62% of British workers spend over £1,800 a year on lunch bought out, versus the £500 spent by those who brought a packed lunch. By eating last night’s leftovers or making yourself a sandwich at home, that’s an annual saving of £1,300. Plus, you will be reducing landfill and your carbon footprint.9

8. Once a week walk to work, or cycle to work or car share

Lloyds Bank found that the average UK employee spends £795.7210 each year commuting to work. So, if you work 5 days a week and you decide to cycle, walk, work remotely or create a car sharing arrangement for two of those days – this means you will save £6.12 per week. That’s a saving of just under £25 per month and an annual saving of £300!

9. Switch from a Standard Variable Rate Mortgage

Many people continue to pay the Standard Variable Rate on their mortgage when more competitive deals are available. The Money Advice Service states that someone with a £175,000 mortgage with a remaining term of 20 years switching from a standard variable rate mortgage at 55 to one at 3% would save £144 a month or £1,728 a year. 11

10. Fit your water tank with an insulation jacket

Simply fitting a hot water tank insulation jacket can reduce your hot water costs by £35 each year.12

For more ways to save, click here:

Additional resources

Help to Save - Backed by the government, ‘Help to Save’ is a type of savings account for those on a low income. It allows certain people entitled to Working Tax Credit or receiving Universal Credit to get a bonus of 50p for every £1 they save over 4 years.

Visit https://www.gov.uk/get-help-savings-low-income for more information.

Coming up in Step 3…

reviewing household debt

Sources

1 BBC: Coronavirus: Money worries in pandemic drive surge in anxiety, 4th May 2020

2 TUC: Work-related stress is a "growing epidemic", 31st October 2018

3 Metro Newspaper: Over three quarters of us are stressed about money, 14th May 2018

4 Forth: Great Britain and Stress, 4th February 2018

5 Ofgem: Save money on your gas and electricity bills

6 Energy Saving Trust: Quick tips to save energy

7 Energy Saving Trust: Draught-proofing

8 British Coffee Association: Coffee Facts

9 PayPlan: Your Guide to Saving Money at Lunchtime

10 YourMoney website: British workers spend 492 days of their lives travelling to work

11 Money Helper: Why it pays to review your mortgage regularly

12 The GreenAge: Water Tank and Pipe Insulation